Efficient financial management is crucial for businesses operating in Kenya. Odoo, a comprehensive open-source ERP system, offers a seamless way to connect your bank accounts, allowing for real-time tracking of transactions. This integration not only saves time but also reduces errors associated with manual data entry. This guide is tailored for businesses in Kenya using Odoo software, helping you automate bank connections or manage statements manually.

Bank feeds are automated connections between your bank account and Odoo. They allow for the automatic import of transactions, ensuring that your financial records are always up-to-date. This feature eliminates the need for manual entry of each transaction, reducing the risk of errors and saving valuable time.

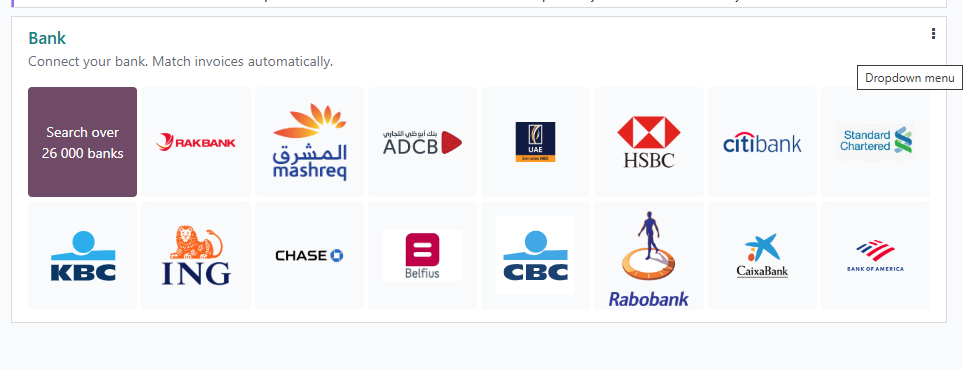

Before setting up any connection, it’s important to confirm if your Kenyan bank is compatible with Odoo’s live synchronization feature:

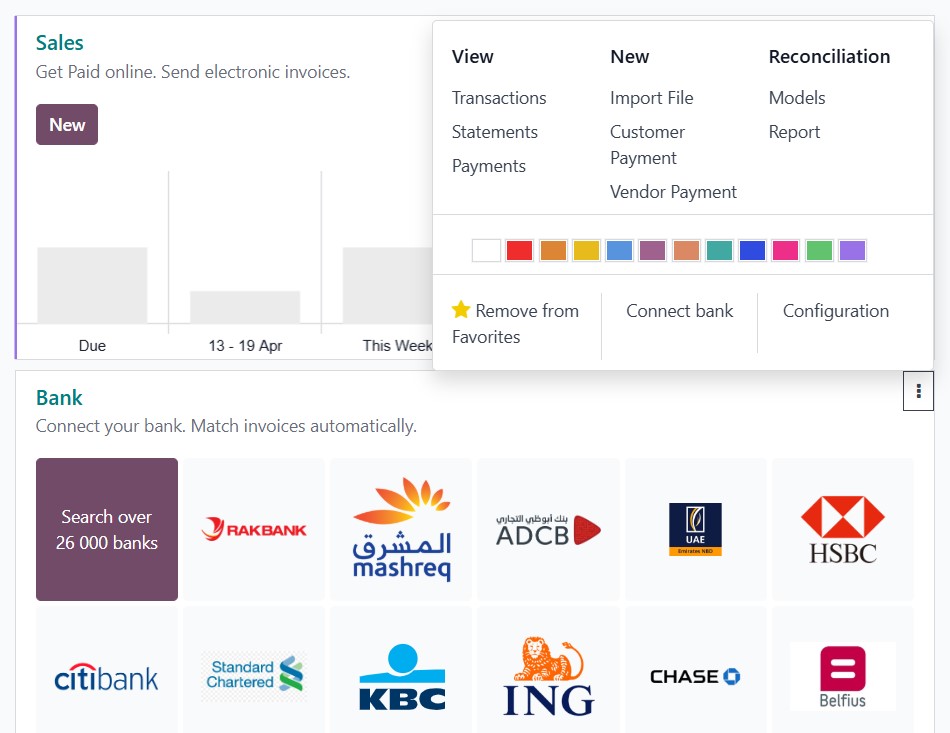

Go to your Odoo Accounting dashboard.

Scroll down to the Bank section and click the three-dot menu (⋮) on any bank tile.

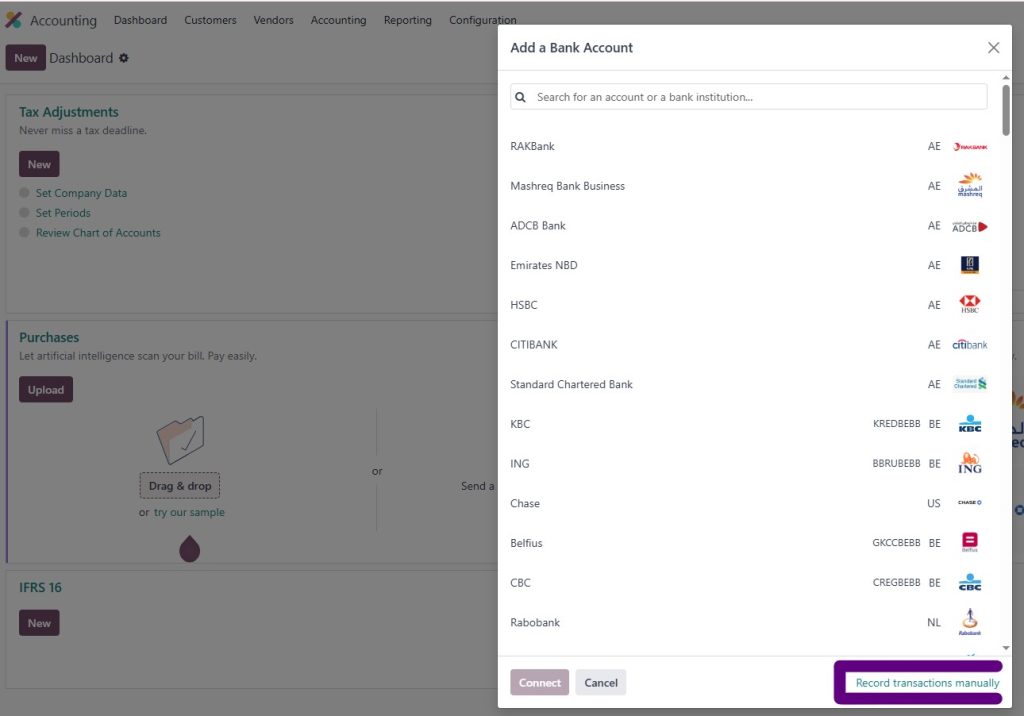

Select Connect Bank to open the integration pop-up.

In the search bar, type the name of your bank (e.g., Equity Bank, Co-operative Bank, Standard Chartered Kenya).

If your bank appears in the list:

It means your bank supports real-time syncing with Odoo.

You can then proceed with the connection process and begin automating your transaction imports.

If your bank doesn’t appear, you can still manage finances effectively by importing your bank statements manually using supported file formats.

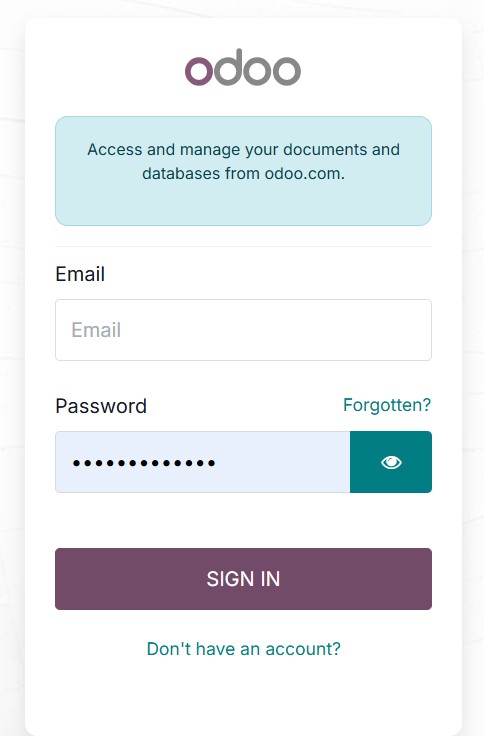

To get started, visit the Odoo login portal:

👉 https://www.odoo.com/web/login

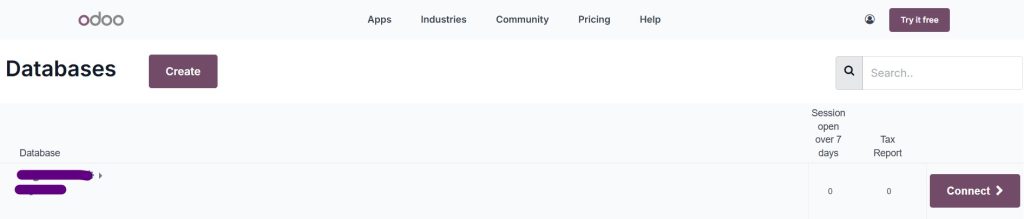

Once you're logged in and on the Databases page, locate your company and click Connect.

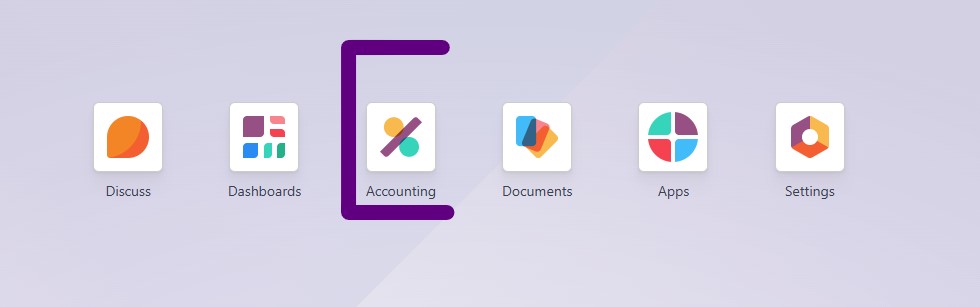

Next, from your Odoo dashboard, click on the Accounting app.

To connect your bank for automatic transaction syncing:

- Click Connect, then follow the prompts to securely log in with your bank credentials.

- Authorize access and complete any two-factor authentication your bank may require.

Done! Your bank is now connected, and Odoo will automatically fetch transactions.

Some local banks in Kenya may not yet be supported for automatic feeds. In that case:

Navigate to the Bank section and click the ⋮ (three-dot menu) on the desired tile.

Select Connect Bank, then choose Record Transactions Manually at the bottom-right of the dialog.

Complete the form with the following details:

Bank Name

Account Number

Bank Identifier Code (IBAN, SWIFT, or Local)

Click Create to finalize the setup.

Once added, you can use the Import File option to upload bank statements in supported formats: CSV, QIF, OFX, or CAMT.

Once your bank account is added and visible:

These tools help you manage your banking efficiently from one place.

When setting up or editing your bank journal (under Configuration > Journals), you’ll need to choose how you want your feed to behave:

Odoo uses temporary accounts for transactions that aren’t matched yet:

You can set these under: Accounting > Configuration > Journals > [Your Bank Journal]

Make sure these are assigned correctly to avoid reporting errors.

Tired of chasing receipts and battling spreadsheets? Let us take the weight off your books.

At Spondoo Kenya, we turn accounting chaos into clarity.

✅ We connect your Odoo to your bank automatically.

✅ We manage your reconciliations accurately.

✅ We handle your taxes compliantly.

✅ You focus on growing your business—we’ll do the math.

📞 Call us today at 0117313555

or

🌐 Visit spondoo.ke to get started